Has it really been 16 months since my previous sales update on Wayward? Wow. Time is flying, gang. I’ve been juggling a slew of different projects this year along with my day job and just didn’t have time to dig into all the numbers until things calmed down.

(Update: I also managed to find time to write up another article about continued sales of Skullkickers after finishing its run that you can read right HERE.)

There’s been a lot of talk about direct market single issue sales through comic shops (also known as the “The direct market”). Sales numbers seem to be declining as retailers jump through ordering hoops for big ticket variant covers while trying not to get stuck with more non-returnable stock than they can handle. I’ve heard from quite a few creators and retailers that juggling numbers on major releases from the Big Two doesn’t leave a lot of time/money to support other publishers, and what is there tends to go to recognizable brands with media pull.

As I’ve mentioned in previous posts, the landscape of media is changing. Every form of entertainment has been shaken up by the digital revolution and a generation of consumers who are growing up with new paradigms that don’t involve owning physical media.

So, with that in mind, here’s how Wayward is faring in a tough market:

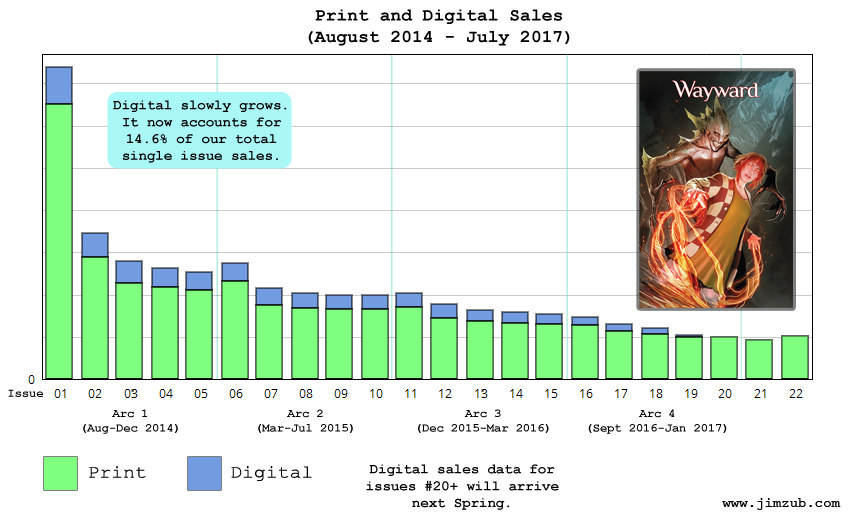

Once again, we’re looking at a classic case of ‘standard market attrition.’ The drops between each issue aren’t severe, but they do start to add up issue after issue, leading to an overall decline. It can be tough to maintain visibility for a creator-owned series that’s long in the tooth (and yes, in this market, Wayward has more issues than many rebooted superhero titles so it looks comparatively old). Comic news sites and reviewers want to talk about the latest and greatest, not a series that’s more than 3 years old with 20+ issues. So, what does this mean for our single issue sales profitability?

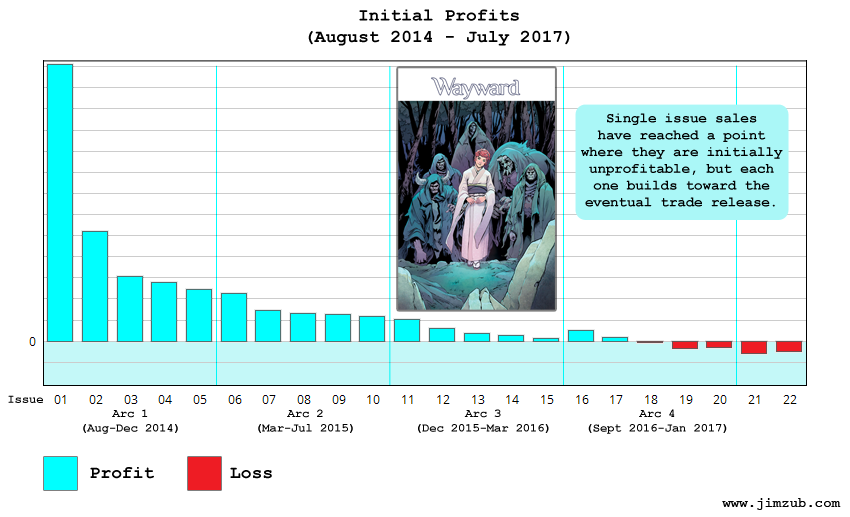

As of issue #18 we’re releasing issues with an initial loss. Obviously, that’s not an ideal situation but I could see where the numbers were leading us and wasn’t surprised. This matches the overall softness of the comic market as a whole. Retailers are cutting purchasing budgets to the bone and many titles are losing ‘shelf copies’, extra copies ordered to see if they can be sold to customers who haven’t subscribed to a title. I’ve been to more and more comic shops where they order single issues for their pullbox customers and only have shelf copies for the biggest releases each week. It’s understandable, given the current sales environment, but it does make it harder for new readers to discover titles…

…Or, does it?

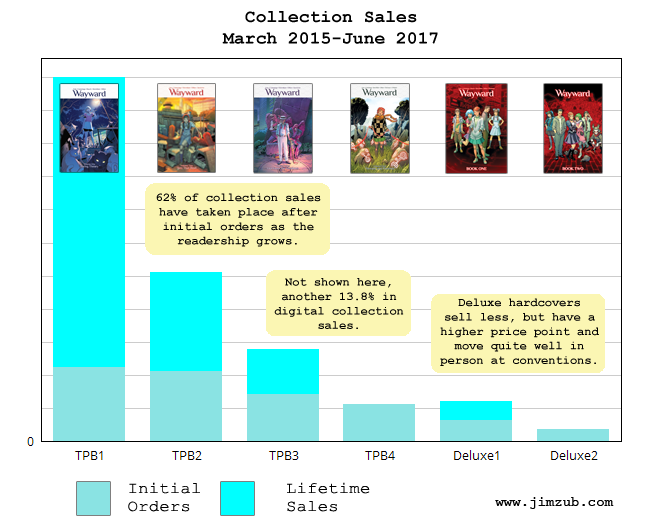

The simple truth is that the market has moved to trade reading. Affordable, durable, easy to lend to a friend or give as a gift, trade paperbacks are now the market for many titles. Wayward trade paperback sales continue to grow and that really drives us forward at this point. Direct market comic retailers support Wayward with their trade orders, but more than half of our trade sales now come from bookstores and other outlets. Initial direct market orders are pretty good, but the long tail of continued sales through other channels keeps us growing year after year. Good word of mouth from people like you keeps us going.

In addition to those single issues and trades, we had two huge visibility boosts that don’t show up properly on these sales charts:

• In early 2016, Image Comics had a Humble Bundle of digital comics promoting diversity and human rights. Supporters who pledged over $20 received a digital copy of Wayward Deluxe Book 1, our packed-to-the-brim issue #1-10 collection with over 80 pages of back matter. That led to thousands of new readers diving into the series and an accompanying boost afterward for digital trade sales.

• Wayward Vol. 1: String Theory is part of comiXology Unlimited, a monthly flat fee all-you-can-read service offered by the leading platform for digital comics. We only get paid a small amount per downloaded trade, but it’s the visibility boost that’s really helped. Tens of thousands of people have read Wayward Vol. 1 through the Unlimited platform.

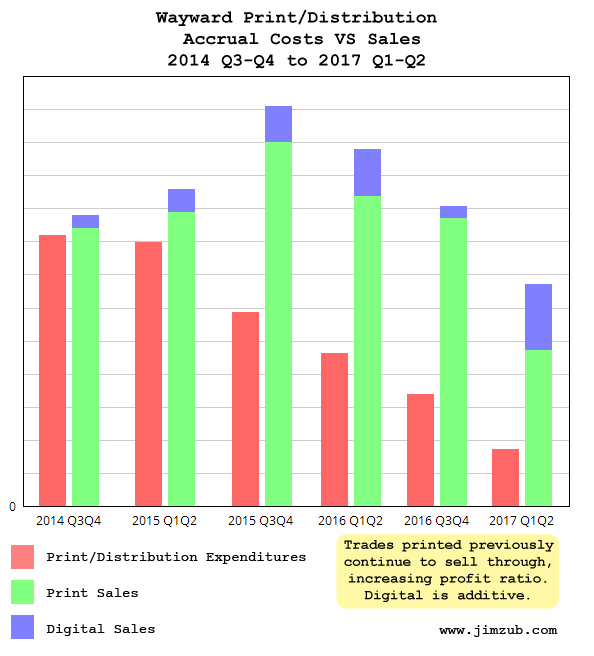

How’s it looking in 6 month increments? Let’s see-

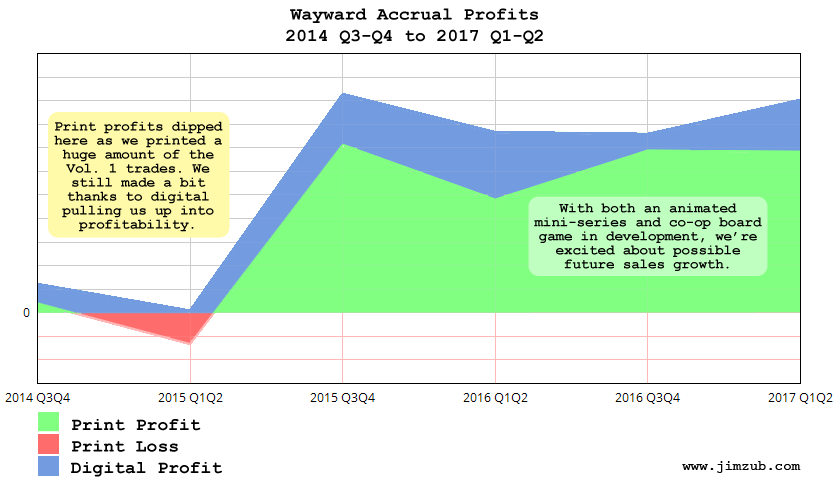

Image printed a huge run of Wayward Volume 1 and 2 and those trades keep selling, so the cost of keeping Wayward in stock stays low while profits continue year after year.

Okay, here’s profit with everything factored in:

In addition to direct market and bookstore sales, this chart also includes a few foreign deals that have been struck to bring Wayward out in other languages, most notably in French from Glénat Comics, with two volumes out so far. Foreign deals are the best because the foreign publisher handles translation, printing, and advertising. For them it’s far cheaper than creating all-new content and for us it rules because we just hand over the print files and get paid.

That small dip in early 2015 was the cost of printing Wayward Vol. 1 with a deep stock to keep us rolling over the long haul, and it’s been pretty smooth ever since. Trade and digital sales have overtaken temporary losses incurred from single issue release. We’re continuing to build our readership in comic shops, bookstores, and online.

Image’s incredible ownership and profit sharing model is unlike any other creator-owned deal in the market. Our small monthly single issue sales and growing trade sales do well enough that Wayward is still Steven’s full-time job (living in Yokohama with a wife and two wonderful kids) and pays a competitive page rate to Tamra, Marshall, Zack, Ann, and myself while giving us the flexibility to make the story exactly the way we want. We don’t get the press coverage of Walking Dead, Saga, Wicked + Divine, Rat Queens or Sex Criminals, but we are solidly plugging away. The additional visibility of an anime series and co-op board game in development could mean even stronger sales for 2018 and beyond.

If you take away anything from this post, let it be this: When fans or news sites only obsess over direct market single issue sales numbers from Comichron (which are not complete, but do provide an overall sense of market leaders and attrition), they are ignorant of a much larger overall market. Comic companies are not obligated to post their sales numbers, but that obfuscation has unfortunately led to a ridiculous amount of armchair quarterbacking by people who cannot see the forest for the trees and are woefully ill-informed about what sells and where. If you only looked at monthly print single issue sales you would assume Wayward was doomed over a year ago, but it’s just not true. The market has shifted and will continue to do so. Readers, retailers, and publishers need to adjust their perception of the market, if they haven’t already.

As always, a quick warning: The above charts only reflect the state of Wayward, my creator-owned comic series. I believe they’re indicative of some broader industry trends, but every series has a different sales cycle depending on the creators involved, publisher, marketing, and whims of the market. Skullkickers and Glitterbomb, my other creator-owned series, have been very different in terms of sales and profitability. Don’t build your own financial plans solely based on these articles.

If you found this post interesting, feel free to let me know here (or on Twitter), share the post with your friends and consider buying some of my comics, donating to my Patreon, or buying comics from me in person if you see me at a convention.

Zub on Amazon

Zub on Amazon Zub on Instagram

Zub on Instagram Zub on Twitter

Zub on Twitter

I’m part of those people who buy the trade. Actually, I only buy trades. More power to Wayward! Love it since the first issue!

I wonder about the loses from issue #18 on.

Does that mean the money from the initial orders does not cover the production costs (pagerates and stuff), or are the printing/ditribution costs calculated in there, too.

And if so, do you, as a creator, pay for printing up front or the publisher, who deducts them from the income?

Thanks for your insight into the industry and … of course…for your comics as well.

Those costs are a mixture of both page rates and printing/distribution costs.

Image does not charge creators for printing, distribution, or their standard flat production fee. In the case of a loss, they eat the cost and deduct it from future income (from accruals paid for re-orders, trade collections, digital, and foreign sales). Other publishers may do it differently, but that’s how Image works.

In this case, my personal cost of writing time and some of the art cost (line art, coloring, lettering) isn’t covered until accruals. Thankfully, as I explained in the post, our trade and digital sales are pretty strong.

Thanks for taking the time to answer. Very much appreciated.

So, as the writer, at Image do you take the full 100% profit and then pay your artist separately?

Every Image team does it differently, but in our case Steven and I co-own Wayward and split profits equally. He receives money ahead of time to make sure he pays his bills and can support his family while working away full time on pages, but when profits are calculated (and the money he was paid is deducted) we split remaining profits.

how does a movie / TV deal factor into that? is getting the adaptation they’ve been talking about earlier in the year a life changer or simply a nice bonus?

I actually talked about that here in this post: https://www.jimzub.com/just-to-clarify-im-not-rich/

This is AMAZING! I shared it to a big collected editions discussion group who loves this sort of inside baseball about comic profitability. For the record, I am someone who bought the trades, kept lending them out and not getting them back :shock:, and then finally switched to the hardcovers (which won’t leave my house) :lol:.

(I know that you addressed this in part in the article so hopefully it’s not too redundant.)

I am one of a growing number of people who digitally trade wait for many reasons. I am curious how your digital trade sales curve looks? Does it match the individual issues curve?