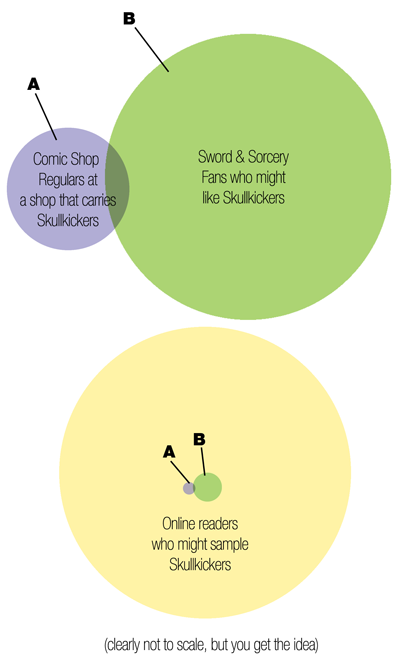

Quite a few people have asked me how sales are going on Skullkickers and whether or not serializing our previous issues online for free has had a negative impact on sales. With the latest accounting information from Image wrapping up 2012 I had a chance to plug those numbers in and was surprised at the results. I’ve removed the dollar amounts from the charts below, but the visuals should give you an understanding of overall trends for analysis.

Digging into the accounting was honestly quite daunting at first. There are dozens of categories, debts and credits applied based on sales, printing, shipping, storage and book orders for conventions. Thankfully each section is broken down with a current loss/gain total and those totals are carried over from previous accruals.

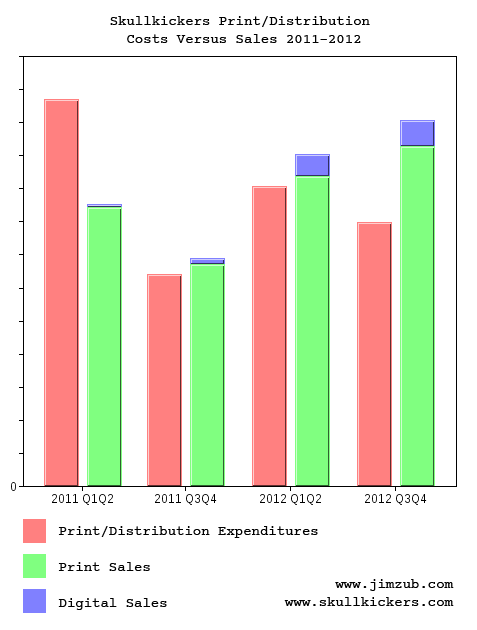

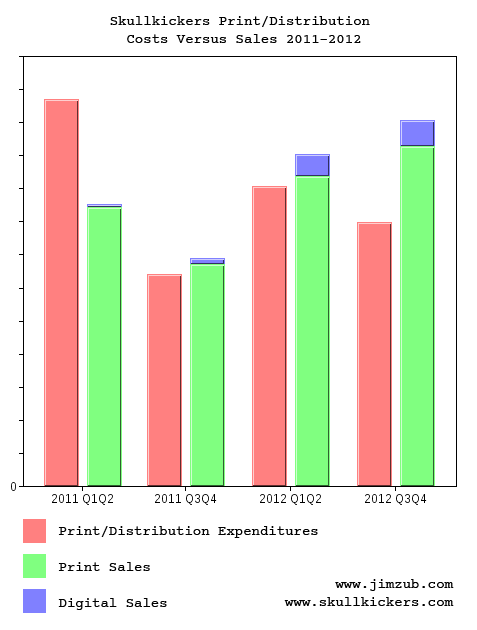

Here’s how Skullkickers has performed over the past two years:

2011 Q1-Q2: We dug into the red aggressively overprinting the first trade paperback to keep it in stock and profits gained from the issues, trade and minuscule digital sales didn’t cover the difference that early into its sales cycle. All in all, we dug down 27% more than we made in the first half of 2011.

For most creators that would’ve been the end of it and that’s totally reasonable. Even with Image covering costs so we didn’t have to spend our own money to print or distribute, the complete lack of profits for 6 months would have sealed the series’ fate. Thankfully, Edwin, Misty and I all have day job income and stuck it out for the long haul.

2011 Q3-Q4: In the second half of 2011 we turned things around, actually making 8% more than we spent for that half of the year. It wasn’t enough to pay back the debt incurred from the first half of 2011, but it showed some promise. Most new businesses have to go into debt to start something new. The fact that within 6 months we were able to reverse that trend and start paying it back was encouraging.

2012 Q1-Q2: Printing a hardcover deluxe collection of 1 & 2 together cost a lot, but we were still able to stay narrowly ahead. Digital made a huge sales jump here compared to 2011 and that corresponds with us starting to serialize Skullkickers online for free. I don’t think that’s a coincidence. Our web visibility exploded and digital comic sales followed. Digital wasn’t a large percentage of total sales, but helped keep our head above water.

2012 Q3-Q4: Now we’re starting to see the benefit of the back catalogue and digital sales as our overall profitability goes up on the series. It’s still not enough to pay off that original debt incurred in 2011 but the overall trend is a positive one. If the first half of 2013 is as strong as the last half of 2012 we’ll be in good shape as we head into the last third of the series (we’re planning six arcs in total).

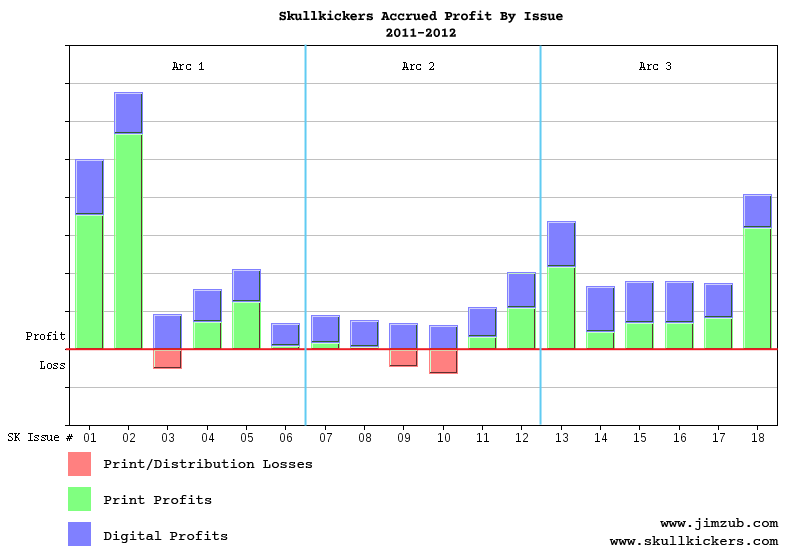

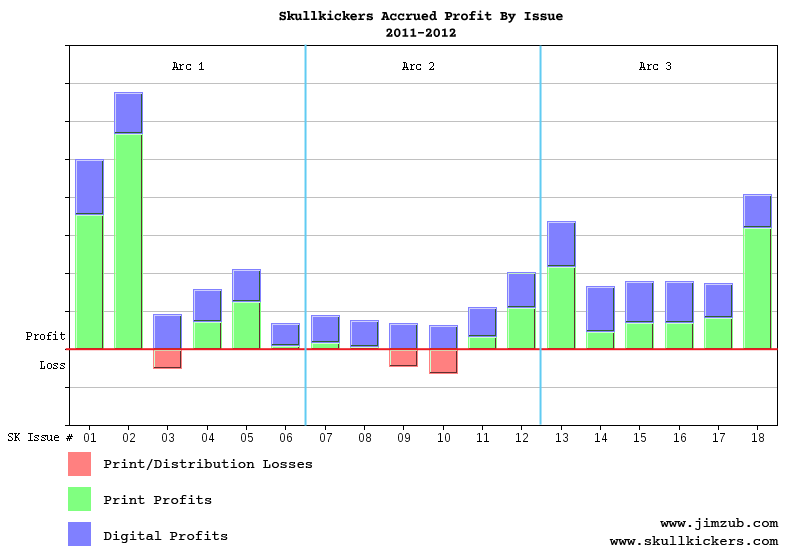

I was fascinated at how the profits broke down by issue:

Keep in mind this is profitability, not sales.

Our first two issues became speculator-hyped and went through multiple printings in the first couple weeks. Issue #1 sold more than #2, but had three printings instead of two, so it became less profitable overall. Even without the exact dollar amount you can see how strong that launch was. I know the tall green bar looks like it would be a lot of money but, without talking exact figures, I will say that the payout on issue #1 and 2 were at a level where an indy creator could sustain a meager existence if that was their sole income. Unfortunately we didn’t stay at that profit level for long.

Issue three narrowly sold out and we decided to do a second printing on it, but reorders weren’t as strong, pushing it out of profitability.

As retailers adjusted their expectations and we settled into a more reasonable sales trend for a fantasy-comedy comic in a serious superhero-centric market we struggled to keep the book profitable at all. Extra press, a comiXology sale and raising the price by 50 cents to $3.50 saved our butts as we headed into issue #13 and our third story arc.

You can really see the profit difference with issue #18 because it was priced at $3.99 for 40 pages of short stories. That extra 50 cents helped a lot. If our print sales dip again I may have to switch it to $3.99 for the regular issues to keep us afloat.

You can see the importance of digital sales here. On issues that have long been out of print the digital version keeps selling 24/7 without any additional printing or shipping cost. That build up of digital sales over 2+ years has put issues like #3, 9 and 10 into profitable territory even though the print versions lost money. You can see how steady the digital sales are too. Not a lot of fluctuation past issue #1. People tend to buy the whole series digitally and the profit margin on that doesn’t fluctuate much. It’s small, but every bit helps.

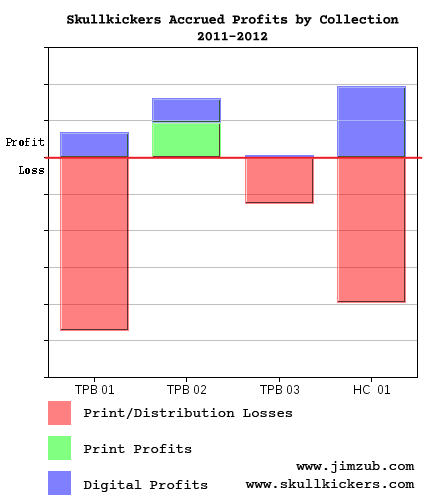

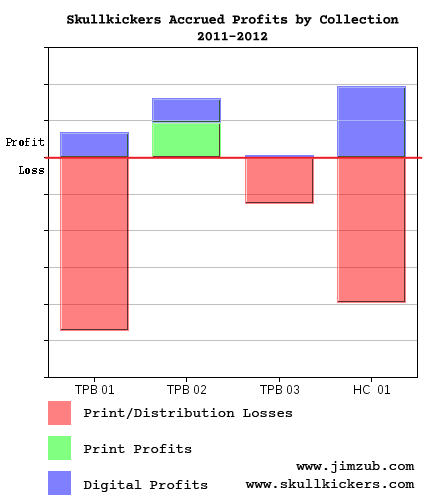

Okay, so you look at that and wonder how we could be so deep in the red if practically all of our issues made some money. Here’s the accrued collection profits:

Ouch, right? Printing and distributing softcovers and hardcovers is a long game with lots of pitfalls. The numbers involved are much larger and a cult book like Skullkickers doesn’t have huge print runs or massive pre-orders to bring in big bucks right off the bat.

Skullkickers Vol. 1: 1000 Opas and a Dead Body is value-priced at $9.99 and has to stay in print otherwise people can’t get started on the series. Keeping this first volume in print at that price point is tough, but we use it as a loss leader to grow our overall readership. Over the long-long haul it pays off if people get on board and pick up other full price volumes. With 6 volumes planned we want the bar to entry as low as possible.

Profitability on volume 1 fluctuates a lot due to larger print runs and the wider push it gets as the entry point for the series. By the midway point of 2013 sales will hopefully catch up with the print debt incurred. Like volume 3, it looks worse here than it really is.

UPDATE April 8th: I received clarification on this from Image Comics’ accounting. There are two reasons why this book is so deep in the red. One is because of bookstore returns/liquidations (Borders collapsing and flushing stock, etc.) and the second reason is because we printed a series of special limited edition hardcover volume 1’s we sold directly at conventions in 2011. The printing and shipping cost is reflected in the accruals, but the money made on them wasn’t through standard distribution, it was direct sales at conventions. Without those two deductions Skullkickers Vol. 1 would be profitable even with its $9.99 cover price. We’re in better shape than I thought!

Skullkickers Vol. 2: Five Funerals and a Bucket of Blood is what we’re aiming for across the board. It has a $16.99 cover price, is selling well overall and has now turned a small profit.

Skullkickers Vol. 3: Six Shooter on the Seven Seas looks dire but keep in mind it just came out as 2012 was wrapping up. The print bill was paid but print sales hadn’t come back yet. By the time we get our 2013 Q1-Q2 statement it should be in similar territory to Volume 2.

Skullkickers Treasure Trove Vol. 1, our 1+2 combined deluxe hardback, is an expensive book to produce. It hasn’t sold like crazy through comic shops but over the long haul I think it will work out because of the high cover price. It’s also a sales dynamo for me at conventions so I want to keep it in print and keep selling it directly to fans.

Again, look at the digital profits. I was shocked at how well digital trades have helped top us up. I wasn’t expecting that at all. Digital comics are picking up steam and work well when added to print sales.

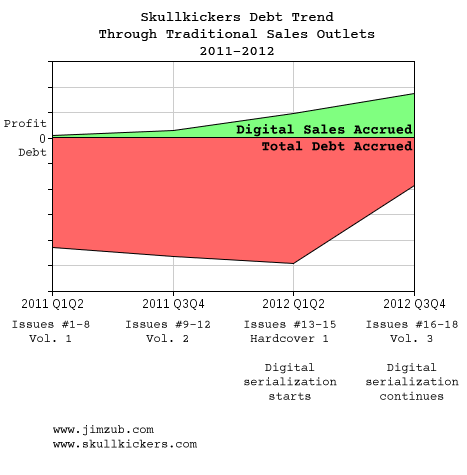

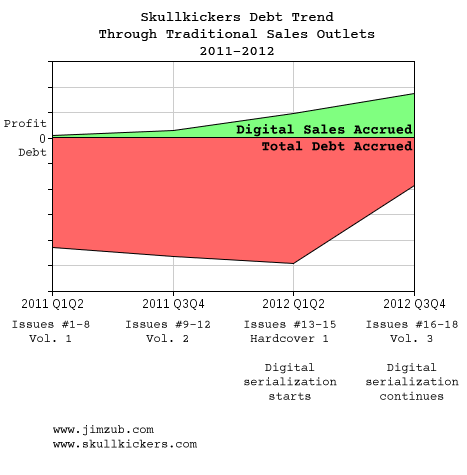

So, what’s the overall trend looking like?

Skullkickers is still in the red, but it looks like we hit our lowest point and are now climbing steadily. Print and digital sales are up and our ridiculous relaunch promotion has garnered a lot of visibility for the series in 2013. The fact that Image has stuck with us and believes in our quality and long term potential gives us a lot more leeway than we’d have at most other publishers. They’re able to make their base amount and keep us rolling. I genuinely believe we’ll be indy-profitable by the time the series is done and the trending numbers seem to agree with that.

Keep in mind this is just analysis of one creator-owned series. As interesting as that is I can’t speak to anyone else’s sales or their financial situation. I don’t think this sales cycle corresponds to all creator-owned books. Please don’t assume every money losing comic will bounce back over the long term and don’t make your own financial decisions based on what I’ve done. Everyone’s risk threshold and situation is different. My next creator-owned project will have a completely different sales life cycle.

Note that these charts don’t include convention sales, which have more than doubled from 2011-2012. The money made from direct convention sales, sketch covers, commissions and selling original page art has helped keep us going and viable. I exhibited at 15 conventions last year and, even though it was exhausting, it paid off in terms of sales and visibility for the series.

Also note that none of the above takes into account freelance work that’s come from working on Skullkickers. If you factor in money made from the writing jobs I’ve done for UDON, Bandai-Namco, Dynamite and DC Comics since the series began, it has “turned a profit” in that way even after paying the art team out of my own pocket. Skullkickers helped me build a 2nd career as a professional comic writer over a relatively short period of time.

Most importantly, we put out a comic that stands favorably beside some of the best titles in the industry and I’m incredibly proud of that. It represents the professional quality and work ethic of our creative team.

If you find my tutorial blogposts helpful, feel free to let me know here (or on Twitter), share them with your friends and consider buying some of my comics to show your support.

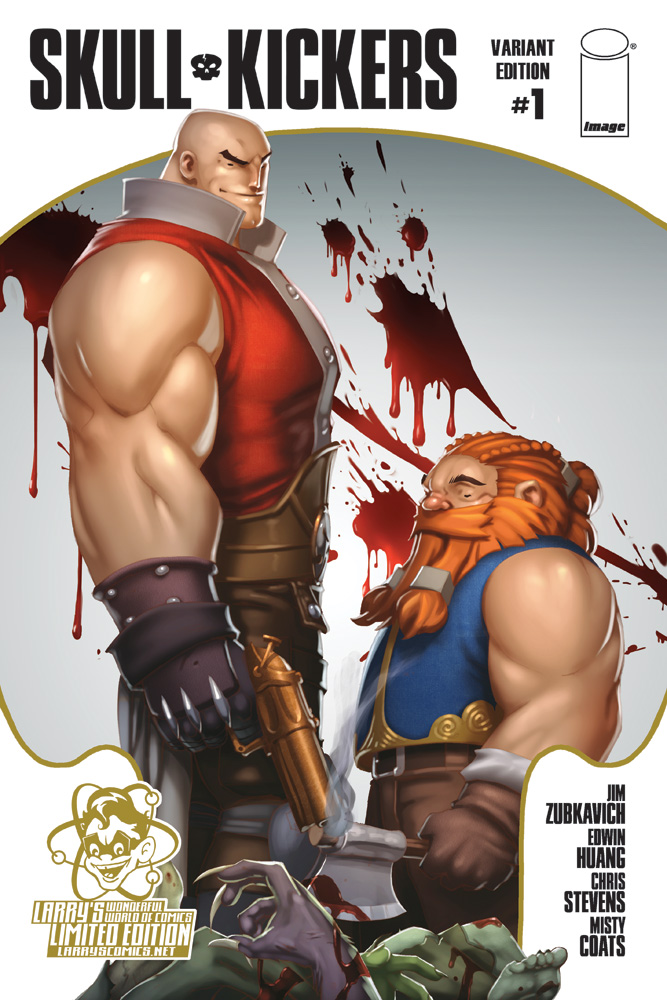

Skullkickers #1 Larry’s Comics Exclusive Cover

Skullkickers #1 Larry’s Comics Exclusive Cover

Our upcoming Uncanny Skullkickers #1 exclusive for Emerald City Comicon

Our upcoming Uncanny Skullkickers #1 exclusive for Emerald City Comicon

Zub on Amazon

Zub on Amazon Zub on Instagram

Zub on Instagram