It’s tax time so I’m seeing a lot of stressful messages on social media from freelancer friends. No one gets into freelance art-writing-animation to crunch numbers, but managing that income is part of the job. You need to make money and also understand how to properly work with it throughout the year.

Everyone’s situation is different, but here are some broad tax suggestions to help you out in the future:

Separate taxes from your income immediately.

Start a separate bank account just for tax money. When you deposit money earned or receive automatic deposits from freelance work, make it a habit to move over at least 30% of that income to the tax account and DON’T TOUCH IT. It’s not your money (yet). Leave it alone if at all possible.

You probably won’t need to pay out that full 30% amount, but having it separate will mean you’re not in a bad spot when tax time comes around, whether that’s a bulk single payment or paying via installments.

Keep track of your business expenses.

Tracking business-related expenses can be a pain, but it’s crucial to saving money: You want to record your business-related equipment purchases, software, reference material, meals, travel – all of it. If you’re not tracking business expenses you’re paying way more than you should in taxes.

Super simple math:

If you make $10,000 in freelance income, but spent $2500 in equipment, travel, and reference in order to make that money, you don’t get taxed on $10,000, you get taxed on $7500.

A 30% tax rate on $10,000 = $3000

A 30% tax rate on $7500 = $2250 (You just saved $750!)

See that? It’s worth it.

One easy way to track those expenses? Get a separate credit card and only use it for business stuff. That way each month you have a simple list of business-related expenses already tallied up and good to go.

In addition, keep paper receipts somewhere easy to access. Have a pen handy so when you put them away you can quickly write down any extra details not on the receipt (who you had dinner with, what the ref is for, etc.).

Do the same with digital receipts. Set up an email folder/tag just for expenses and file those away for later: software purchases, digital ref material, business travel bookings you’re not being reimbursed for, etc.

Reference material can also be the stuff you love.

If you work as a freelance creator, it’s your passion and hobby, but that doesn’t mean those things you buy aren’t business expenses.

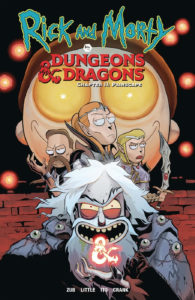

• Comic freelancers write off comic purchases.

• Independent game designers write off game purchases.

• Freelance animators write off animated movies and art books.

Fill in the blank for a dozen other creative fields. It’s not cheating, it’s part of your job: reference and research is how you keep current and improve your work.

There is a limit, of course. You can write down a loss if you spent more than you made while getting your business up and rolling, but the tax man won’t accept that year after year without growth. You can’t claim to be a freelancer to tax shelter your actually hobby.

When Skullkickers (my first creator-owned series at Image) started, I spent more on art/promotion than I made so I wrote off expenses that added up to more than my freelance income, but it was only for two years.

Income is income.

Paypal is income.

Patreon is income.

Both sites are required to hand over records to tax offices if requested. I know it can feel like ‘free’ digital money, but don’t look at it that way as it can really bite you later.

Same goes for Ebay auctions you run, Etsy crafts you sell, and items/commissions you make money from using Square or any other digital currency transfer.

Don’t think that just because it’s digital it doesn’t count. We live in a digital world. It all counts.

Know where your money is coming from.

Keep track of your freelance income. Seeing where your money is coming from (specific clients, projects, conventions) makes it way easier to plan and budget for the future. Over longer periods you’ll see patterns as your career develops.

Also, if you’re being paid in foreign currency, keep track of the conversion amount for your records. You need to know how much the money you deposited turned into with conversion to your local currency. Write it down as soon as you get that bank receipt or digital confirmation so your records are accurate. At the time of this article, I get approximately $1.26 in Canadian dollars for every US dollar I deposit. That’s 26% more money I use to pay my taxes, but also 26% more income I have to accurately keep track of.

Oh God, the Tax Man is coming!

If you get an audit request from the IRS (US) or CRA (Canada), they won’t throw you in jail. It also doesn’t mean they assume you’re a crook. In most cases they just mail you a letter asking for receipts that match a category total you claimed. That’s it.

As long as you claimed the things you have receipts for, you are A-OK. Don’t stress it. Photocopy/scan those receipts for your records and send them to the tax office. They’ll confirm and you should be fine.

If there are severe discrepancies, they may choose to do a full audit. Oh $%&#, a full audit? Yeah, that’s a pain, but you did it to yourself if you claimed stuff you don’t have records for.

Again, no one is going to jail. They’re just going to ask for ALL your records for specific years to confirm your totals claimed. They will recalculate your taxes based on any missing information and will charge you back taxes (along with a penalty). I’ve seen people go through it. It sucks, but you will survive. Expect that you’ll get frequent audit requests moving forward for several years until they know your numbers are all properly logged.

I’ve been contacted about my taxes multiple times. It’s not a big deal. The Canadian Revenue Service was quite confused by a large amount of freelance income where I wasn’t charging my clients HST (tax) on it until I proved that was all from US-based/US dollar income (which don’t require an HST charge), then I was fine.

An accountant is worth it.

Even with good record keeping, I’d recommend getting an accountant if you make substantial freelance income. They know extra options to write off things and ways to legally balance the numbers better than you do. That’s their job. Just make sure you keep good records and you’ll save them time, hassle, and hours spent trying to figure out what all your numbers mean.

Oh yeah, and here’s the other kick, whatever you pay the accountant for doing your numbers is also a business write-off! If they save you a decent amount (and they probably will) it actually does pay for itself.

I don’t want to go into specifics because tax law and write-offs vary wildly from country to country, sometimes even state to state. A good accountant will know exactly what will work best in your region: expenses, home office write-offs, travel, retraining, all of it.

Start now.

For new freelancers, you’re trying to avoid the Tax Whirlpool, that awful situation where you use current income to pay last year’s higher-than-expected tax bill, which drains your account so you don’t put aside the tax money you should now…Rinse and repeat.

For current freelancers who may be struggling with this stuff, use the frustration of dealing with this year’s tax burden as the impetus to break those bad habits. Start tracking expenses today. Start putting aside the tax amount as best you can moving forward now. Some is always better than none.

You got into this business because you want to create, but it is a business. The more care you take setting up your tax/expense tracking, the less stress you’ll deal with and the more time you’ll have to concentrate on what matters: the work.

If you found this post helpful, feel free to let me know here (or on Twitter), share the post with your friends and consider buying some of my comics or donating to my Patreon to show your support for me writing this instead of doing paying work I can pay taxes on. 😛

Zub on Amazon

Zub on Amazon Zub on Instagram

Zub on Instagram Zub on Twitter

Zub on Twitter

Thanks so much for this Jim! I am almost to the point to where I want to start publicly freelancing my art, and this information came up at the most perfect time. awesome awesome stuff, and humorously narrated at that. Thank you for paving the way for us come tax time. *thumbs up*

Thanks so much for sharing this resource at Halcon 2022.